The CEO of daily fantasy sports operator FanDuel says he won’t push to take the company public until the regulatory landscape becomes clear.

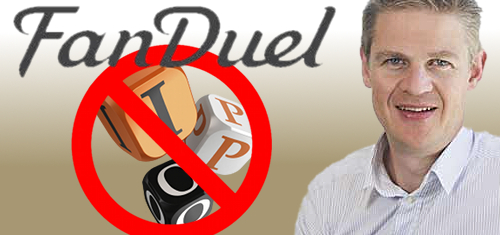

Speaking to Bloomberg Business, FanDuel CEO Nigel Eccles (pictured) said plans for an initial public offering had been shelved because the ongoing push by US state and federal legislators to impose regulations on the DFS industry – not to mention all those criminal investigations – had created an unacceptable level of uncertainty in the minds of investors.

Eccles said that an IPO would only work if the company could show it was generating both growth and profits, and while the company has undergone significant growth this year, profits remain elusive. Eccles insists that FanDuel would be profitable were it not for its relentless TV ad spending over the past two months, which even Eccles admits went a little overboard. Eccles vowed to focus on less expensive digital advertising in the future.

That may solve the profit part of the equation, but the growth part is hard to argue at the moment, as both FanDuel and rival DraftKings just reported their third straight week of declining participation. Eccles maintains that the 13% decline in participation since the site’s Oct. 11 peak was a seasonal phenomenon and predicted that the coming weekend would be the biggest in the site’s history.