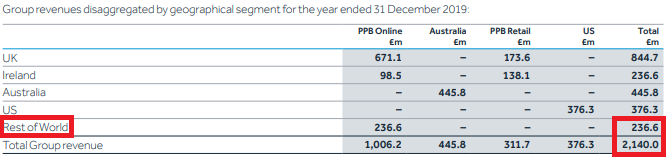

It’s hard to hide my exasperation at financial markets right now, especially in the United Kingdom. They make no sense. Take Flutter, for example. It just lost a big chunk of its revenues after fleeing unregulated markets in Macau, Taiwan, and China, and it’s only down 1.3% today, still near all time record highs. It’s another sign that deglobalization continues apace and governments are getting more insular and cranky while their revenue streams dry up. It’s impossible to know exactly how much revenue Flutter is losing in this sad retreat. It could be as much as 11% of total sales, but we just won’t know until the next annual report. I say 11% because of this table from page 122 of Flutter’s 2019 annual report.

(Those super exquisite red boxes are my own addition. *Takes Bow*)

Nowhere in Flutter’s annual report do the words “China”, “Macau”, or “Taiwan” even come up. Best not to bring too much attention to these grey markets unnecessarily. Not that I’m against operating in unregulated markets. Offering gaming services to people who want to play promotes peace and cooperation. It’s just that investing in grey markets isn’t exactly my cup of Earl Grey. They may be lucrative, but only so long as governments and their bureaucrats remain fattened and sedated by their existing tax revenues enough to look the other way. Once the power brokers at the top get frazzled and worried, the chain of hassling from the top down gets activated. Bureaucrats get antsy and aggressive, fearing for their own livelihoods, and grey markets get shut down.

Maybe this is a big loss for Flutter. Maybe it isn’t. The bigger picture though is that this exit is just the beginning, and Flutter will not be the only victim by any means. We are going to see a swell of exits from all kinds of grey gaming markets all over the world in the coming months. Companies heavily reliant on revenues from these places are going to get smashed. (Except for GVC of course, which never goes down.) Unfortunately, the crackdown on grey markets will likely hit gaming companies first before other industries get lined up before the firing squads, because of course the gaming industry is the whipping boy for tax increases when regimes get desperate.