Kenya’s sports betting operators thought they’d successfully dodged punitive tax hikes but the country’s president is saying ‘not so fast.’

Late last month, Kenya’s parliament voted against proposals to impose a uniform 50% tax on all gambling revenue. The proposal, which was included in the country’s Finance Bill at the request of Treasury Secretary Henry Rotich, represented significant increases for betting operators, who had been paying only 7.5% tax on betting revenue.

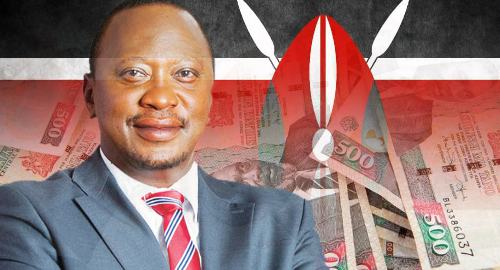

On Tuesday, Kenyan President Uhuru Kenyatta (pictured) upended the MP’s proposal by declining to sign the Finance Bill into law. In a memo to the Speaker of the National Assembly, Kenyatta claimed that the proposed tax hike was necessary to curb Kenyan youth involvement in betting activities, and parliament’s decision to leave taxes as they were “totally negates the spirit underlying the proposal to have the betting tax raised.”

Kenyatta has offered parliament an easy way to ensure an amended Finance Bill meets with his approval – impose a new uniform 35% tax on gambling revenue. This rate would apply not only to sportsbooks but also to gaming, lotteries and competitions, which are currently paying tax rates of 12%, 5% and 15%, respectively.