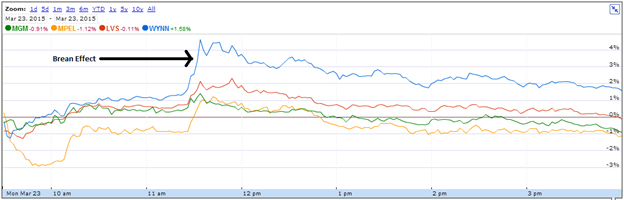

Macau stocks jumped yesterday in response to a Brean Capital Buy rating for four casinos in particular: Wynn, Las Vegas Sands, Melco Crown, and MGM. In response to the coverage, all four stocks jumped. Wynn in particular traded in a huge 7% range yesterday. But by the end of the day, 3 out of 4 of the stocks were down, with the exception of Wynn.

Bryan Maher is the Brean analyst who wrote the report, and he is being called contrarian here, as most Wall Street firms remain bearish on Macau. While I am certainly not bullish, Maher’s reasoning is not entirely without merit.

First I will say that in general, free advice given by Wall Street firms is not something I generally pay much attention to. What a firm publishes for public consumption versus what it tells or does for its paying clients is sometimes very different. In some cases a firm may publicize what it actually thinks in order to better its reputation and go on a client hunt. Oftentimes though, a firm may publicize the opposite of what it thinks in order to sell into strength or buy into weakness and so benefit its existing clients.

There are two ways to investigate what is going on with any given call using publicly available information. The first is to look into money flows a month or so before and after a given rating. Selling on Strength and Buying on Weakness numbers are available every day at the Wall Street Journal with archived data. If you have the time and inclination to set up large spreadsheets spanning a two-month timeframe and go on a hunt for Wynn, LVS, Melco, or MGM, then by all means. Nothing showed up on either side for any of the four stocks yesterday, for what it’s worth. Second, you can look into any form 3, 4, 13D or 13G filed with the SEC surrounding any call. Any large stake 10% or more requires a 3 or 4, and anything between 5% and 10% requires a 13D or 13G. Obviously, if you see any of these forms filed by any Wall Street firm either confirming or contradicting a public call, you know what’s really going on. As Jim Rogers says, 99% of investors don’t take the time to find these things because it’s a tedious job, and worse, it’s all archived by government websites which are pretty horrible. Not to mention the fact that a firm can always acquire less than the reporting threshold anyway.