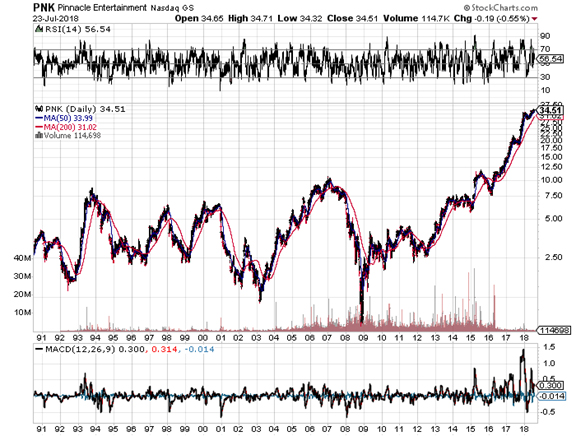

Rarely do fundamental trading patterns change for a stock, assuming the company remains basically the same. What has been, will continue to be, barring a fundamental change of the company itself. For regional gaming companies in the US, nothing has fundamentally changed since the 1990s. Sure, the companies have grown and done well, but they remain the same sort of momentum stocks that rally hard with the business cycle boom and fall hard with the bust. Looking at a long term chart of Pinnacle for example, the stock has never rallied on a slow-burn, neither has it gently declined over long periods of time. Either it’s zooming up, or it’s collapsing. If you own it, expect more of that.

A long term chart of any of the US regional gaming stocks looks both enviable and scary. Anyone who bought at market bottom in early 2009 now stands on gains of thousands of percent at least. 1000% for Pinnacle, 3,700% for Penn National Gaming, and 1,300% for Boyd. It can be tempting to try to establish a position now and try to eke out some of those gains, but it makes sense to first try to see why these stocks rally and why they collapse so hard. Is it for any fundamental reason, like earnings are revenues or growth prospects, or is it mostly just the nature of the way the regional sector trades? It looks like traders just tend to pile into these momentum plays all at the same time because that’s what everyone else does, and then exit at the same time when overall economic conditions worsen.

It’s easy to make a glib statement like, “These stocks are rocketing higher because these companies are doing awesome!” Maybe they are, but it pays to take a little time to see if they’re moving they way they strictly because of that, based on past movements. Granted, even if fundamentals weren’t the primary factor back then doesn’t mean it isn’t the case now, but chances are a stock will keep behaving just like it has in the past. So let’s take a look at how each of these companies was doing financially last time each of them exploded higher, and what was happening the last time they collapsed.

Boyd